Scams targeting older adults are becoming more common. In fact, elder fraud complaints to the FBI’s Internet Crime Complaint Center (IC3) rose by 14% in 2023, affecting many thousands of American seniors.

Today, we’ll be covering essential information and practical tips to help protect the elderly from scams. We’ll review common scams aimed at older adults, warning signs to watch for, and steps to guard against financial fraud and identity theft.

Key Takeaways

- Seniors should stay informed about phone fraud, phishing emails, door-to-door schemes, and other common scams.

- Regularly discuss financial safety with seniors and encourage them to double-check decisions regarding money.

- Routinely check seniors’ bank and credit card accounts for suspicious activity.

- Use resources like the National Elder Fraud Hotline, ElderCare Locator, AARP’s Fraud Watch Network, and ScamSpotter.org for scam prevention and recovery.

Why Are Seniors Targeted?

Scammers often target older adults for several reasons:

- Substantial Savings: Many seniors have built up significant savings, making them appealing targets for financial exploitation, such as scams involving gift cards, debit cards, and wire transfers.

- Tech Trouble: Some older adults might not be as tech-savvy, making it harder for them to spot and avoid scams such as phishing emails, tech support scams, or fraudulent text messages from con artists.

- Cognitive Decline: Cognitive decline can make seniors more vulnerable to deception and less able to identify fraud or recognize con artists. This vulnerability can lead to various types of financial abuse and elder abuse.

- Trusting Nature: Scammers often see older adults as more trusting and less likely to report scams due to fear, shame, or not knowing where to get help. This makes them prime targets for fraudsters using impersonation tactics or claiming IRS issues.

Additionally, many older Americans receive notifications regarding their social security, Medicare, and other health care services, which fraudsters can exploit. The prevalence of romance scams, grandparent scams, and sweepstakes scams further highlights the need to understand why seniors are often targeted and need your help.

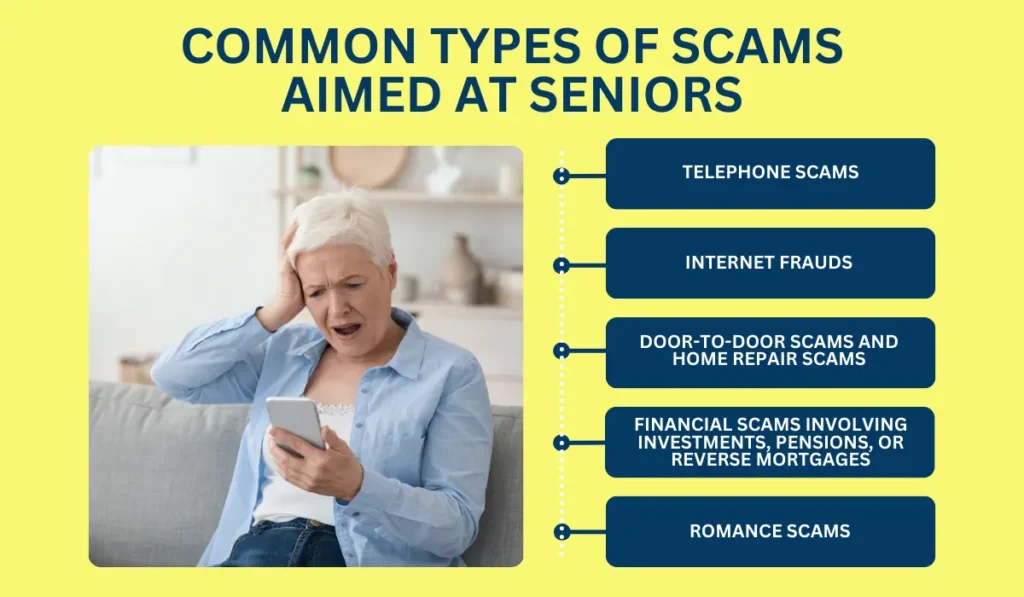

Common Types of Scams Aimed at Seniors

With scam artists increasingly targeting seniors, it’s crucial to recognize the tactics they use. Here are some common scams aimed at seniors and how they work:

Telephone Scams (e.g., fake charities, lottery scams)

One of the most common ways scammers target older adults is through phone calls. They use various tactics, such as posing as fake charities asking for donations or telling seniors they have won a lottery and need to pay a fee to claim their prize.

These scammers often prey on emotions, using stories about sick children or natural disasters to elicit sympathy and convince seniors to give away money.

Internet Frauds (e.g., phishing emails, bogus online marketplaces)

Seniors who use the internet are at risk of falling victim to online scams. Phishing emails, for example, trick recipients into providing sensitive information like bank account details or login credentials.

Bogus online marketplaces also target seniors, appearing legitimate but never delivering on their promises.

Door-to-Door Scams and Home Repair Scams

Scammers may knock on the doors of seniors, pretending to be salesmen or repair workers. They try to sell fake products or services or demand payment for unnecessary repairs.

Seniors who live alone, have cognitive impairments, or need assistance with household chores are more likely to fall victim to these scams.

Financial Scams Involving Investments, Pensions, or Reverse Mortgages

Seniors with substantial savings and retirement accounts are at risk of financial scams. Scammers may offer fake investment opportunities, promise unrealistic returns on pension plans, or push seniors into taking out reverse mortgages that deplete their assets.

Romance Scams

Romance scams exploit emotional vulnerability and often lead to significant financial abuse. Fraudsters posing as potential romantic partners build trust before asking for money or personal information, such as social security numbers or bank account details.

Be wary of any online romantic interest who asks for financial help, primarily through wire transfers or gift cards, and avoid sharing personal information like credit card numbers.

Preventative Measures to Protect Seniors

Protecting seniors from scams involves staying informed, maintaining open communication, monitoring financial accounts, and using technology wisely.

Here’s what you can do to help.

Learn How to Spot Financial Abuse

Knowing how to spot the warning signs is essential to protecting seniors from financial abuse. Look out for unusual financial activity, such as large or unexplained transfers, new loans, or changes in spending patterns. Fraudsters may impersonate trusted individuals or use deceptive tactics to gain access to financial information.

Stay Informed and Communicate Regularly

It’s essential to keep updated on the latest scams targeting seniors. Watching news reports, following trusted government agencies, and reading articles on fraud can help you spot red flags or warning signs. Regularly discuss financial safety with seniors and ensure you:

- Talk about common scam tactics like fake phone calls and phishing emails.

- Remind them never to give personal information over the phone or internet without verifying its legitimacy.

- Encourage them to seek a second opinion before making any financial decisions.

Monitor Financial Accounts and Set Up Protective Measures

Keeping a close eye on seniors’ financial accounts can help detect suspicious activity early. Routinely check their bank and credit card accounts for unusual transactions and report them immediately.

Scammers often make small test withdrawals before attempting larger thefts, so catching these early is crucial. Additionally:

- Set up a power of attorney or designate a trusted contact person to assist with financial decisions.

- Ensure someone else is aware of their financial situation and can intervene if necessary.

Educate and Use Technology Wisely

Educating seniors about protecting their sensitive information is vital. Encourage them to be cautious about giving out personal details, especially over the phone or online. Staying updated on technology is also essential.

Teach them how to set up privacy settings on social media accounts and enable two-factor authentication where possible. These steps add extra security to help prevent unauthorized access to sensitive information.

Tools and Resources

Many resources and tools are available to help seniors protect themselves from scams. Some of these include:

- National Elder Fraud Hotline: The U.S. Department of Justice’s Office for Victims of Crime supports fraud victims aged 60 and older. Call 833-372-8311 for assistance.

- ElderCare Locator: Connects older adults with community resources, helping scam victims recover financially and emotionally.

- AARP’s Fraud Watch Network: A platform for seniors to report scams and get protection tips.

- ScamSpotter.org: A Better Business Bureau website helping seniors identify and avoid common scams.

What to Do If a Loved One Gets Scammed

Despite taking preventative measures, seniors can still fall victim to scams. If you suspect that a loved one has been scammed, here are some steps you can take:

- Stay calm and supportive: It can be embarrassing for the senior to admit they were scammed, so it’s essential to remain patient and understanding.

- Report the scam: Help them report it to the appropriate authorities (e.g., FTC, local police).

- Contact financial institutions: Freeze any compromised accounts.

- Seek legal advice: Consider consulting a lawyer to assist in recovering lost funds.

- Encourage communication: Urge your loved one to speak with a trusted family member or friend about what happened.

The most important thing is to provide emotional support and reassure your loved one that it’s not their fault. Together, you can work towards preventing future scams and protecting their financial well-being.

Consider using reputable home care services that employ vetted workers to provide additional support and ensure a safer environment for your loved one.