The term “senior citizen” can be daunting for older adults, and is defined differently by different people. The senior population has grown rapidly in recent years–1 in 6 Americans is over 65 as of 2020.

Whether you’re looking into home care services or wondering if you qualify for certain tax exemptions, you might be asking yourself if you or a loved one already qualifies as a senior by law. Read on to learn who qualifies as a senior citizen in New York and what benefits they may receive.

Key Takeaways

- While “senior citizen” is defined differently when it comes to a variety of programs and services, New York State generally considers anyone 65 years of age or older to be a senior citizen.

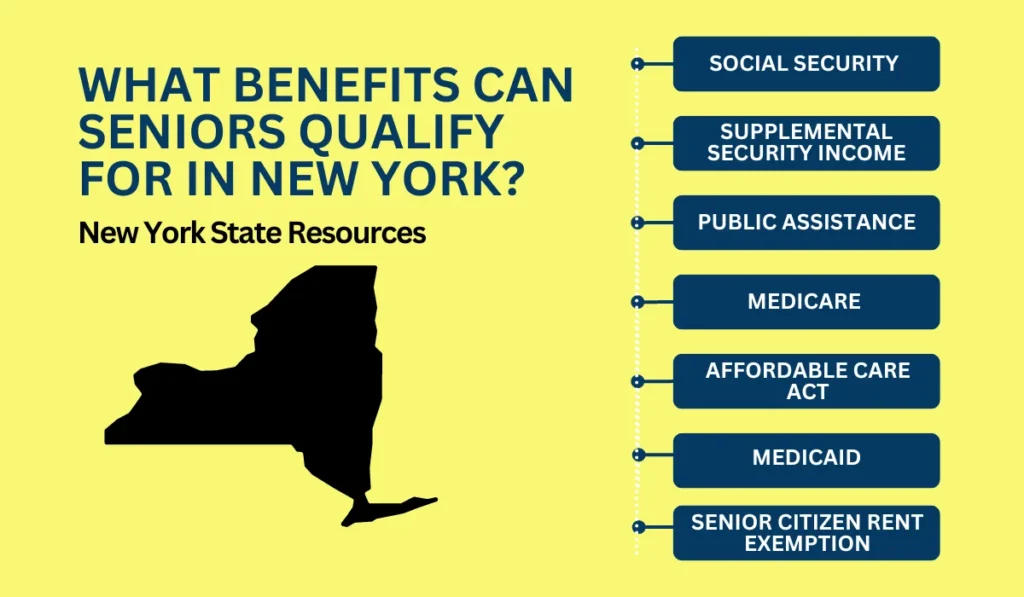

- Senior citizens qualify for a variety of benefits in New York, like Social Security, tax relief, Medicare, and rent increase exemption.

- Senior New Yorkers are exempt from income tax withholding, may receive property tax benefits, and may receive certain forms of tax-free income (i.e. pensions).

Apply for CDPAP or HHA today

What Age Qualifies as a Senior Citizen in New York?

If you’re wondering if you or a loved one qualifies as a senior citizen in New York, you might’ve been met with mixed answers. Senior discounts, federal and private programs, and retirement communities across the country define the qualifying age to call oneself a senior citizen differently.

For instance, once you turn 50, you’re eligible to join AARP, but you may not opt into Social Security benefits until you turn 70 (in order to receive an increased monthly benefit). Your legal full retirement age could be 65, 66, or 67 depending on the year you were born.

However, in New York State, the cutoff at which one is considered a “senior citizen” is 65 years old. Once they turn 65, New Yorkers gain access to a variety of benefits, from tax exemption to more affordable electricity and heat via HEAP (Home Energy Assistance Program) to reduced fare for transportation via MTA to food stamps via SNAP (Supplemental Nutrition Assistance Program) to Medicaid and prescription drug coverage (Elderly Pharmaceutical Insurance Coverage program, or EPIC).

What Benefits Can Seniors Qualify For in New York?

People 65 and older in New York State qualify for a variety of resources. Read on for a summary of each, or read our more in-depth breakdown here.

Social Security

Social Security, provided by the U.S. Social Security Administration, is a program offering financial protection for senior citizens. When you retire, monthly Social Security payments replace a portion of your pre-retirement income, which is calculated based on your lifetime earnings.

While you work, you pay taxes into the social security system, which you are then able to access in retirement (you can receive reduced payments as early as 62, or opt in to begin receiving increasing monthly payments anytime up until you turn 70).

Supplemental Security Income

Supplemental Security Income (SSI) is also provided by the U.S. Social Security Administration. The SSI program provides additional monthly payments to senior citizens who have little access to other income and resources.

Income limits as well as your living situation (i.e. whether you live in someone else’s home) are factored into how much you’ll receive each month.

Public Assistance

Public Assistance (PA), also known as Temporary Assistance (TA), is available to those who can’t work, are unable to find a job, or have a job that doesn’t pay enough. Qualifying senior citizens can have some of their monthly expenses paid for by PA.

Medicare

Medicare is federally provided health insurance for those 65 and older. If you’re already receiving Social Security benefits or benefits from the Railroad Retirement Board, you’ll automatically receive Medicare. Otherwise, you’ll need to look into enrollment and choose a plan.

Generally, Medicare covers inpatient hospital care, skilled nursing facility care, nursing home care, hospice care, home health care, medically necessary services, and preventative services.

Affordable Care Act

The Affordable Care Act (ACA) is a comprehensive healthcare reform law. This law ensures federal tax credits with households whose income is between 100% and 400% of the federal poverty level (FPL). The ACA provides coverage for everything from hospitalization and prescription medications to mental health services and urgent or emergency care.

Medicaid

Medicaid is federally provided health insurance for low-income households. Individuals over 65 with limited resources (per a “resource test”) qualify for Medicaid in New York.

Medicaid offers a full range of health services, ranging from regular medical checkups and hospital stays to lab tests, medical supplies, in-home care, and nursing home care.

Senior Citizen Rent Exemption

The Senior Citizen Rent Increase Exemption (SCRIE) program allows qualifying senior New Yorkers to have their current rent frozen and be exempted from any future rent increases.

Lower-income individuals over 62 can continue to pay their current rent for life regardless of rent increases, while landlords receive a property tax credit covering the difference for any subsequent increases.

Do Seniors Still Pay Taxes in New York?

Senior citizens in NYC and New York State at large may qualify for a variety of tax benefits and exemptions. People over 65 are exempt from New York State and New York City income tax withholding, as long as they did not have a New York income tax liability in the previous year and do not expect to have a New York income tax liability in the coming year.

Additionally, real property taxes may be reduced by up to 50% for qualifying lower-income seniors. Seniors may also receive income that doesn’t have tax withheld, such as pension or annuity income. All Social Security retirement benefits are exempt from taxation. All of these factors make New York a very tax-friendly state for senior citizens.